How to Stake in Initia: The Guide to INIT, LP Tokens & Enshrined Liquidity

Introduction

What’s Initia, really? 🪢

Initia is a custom Layer 1 built on the Cosmos SDK — but it’s way more than just another chain. It acts as the core coordination layer for a whole ecosystem of rollups, and it solves two big problems most L1s still haven’t figured out:

- Makes rollup deployment and operation seamless through the Interwoven Stack

- Maintains unified liquidity and interoperability across the ecosystem

Initia runs on a single validator set that secures both the L1 and all connected rollups. At the heart of the network is InitiaDEX, a native liquidity hub that ties everything together. One of the standout features is Enshrined Liquidity, where LP tokens don’t just earn swap fees — they also double as staking assets and boost capital efficiency.

The platform supports a multi-VM rollup framework, meaning devs can launch rollups using EVM, MoveVM, or Wasm, depending on their needs. And thanks to built-in cross-rollup interoperability, assets and messages can flow seamlessly between rollups without needing clunky bridging layers.

Why Stake on Initia?

Staking isn’t just for yield — it’s how a network shows what it cares about and who it’s built to reward. Most L1s treat staking like a box to check. Throw some emissions at validators, inflate the token, call it "secure", but in reality that model hasn’t aged well.

Yes, staking INIT helps secure the network, but the real play here is how staking ties directly into liquidity, governance, and capital flow across the Interwoven Economy.

You can go the traditional route and stake INIT with a validator — you'll earn emissions and help maintain consensus. But if you’re actually trying to use the chain and not just sit on your stack, Enshrined Liquidity staking is something you'd be interested in. You provide liquidity to a pool like INIT/USDC, stake your LP tokens, and now your assets are working on multiple fronts: securing the chain, powering trading activity, and earning INIT rewards.

To shape how emissions are distributed, you lock your tokens. The longer the lock, the more voting weight you get through VIP gauge governance. So if you want your pool to earn more INIT — lock in and vote.

Initia has committed 25% of its total supply (250,000,000 INIT) specifically to staking and Enshrined Liquidity incentives. Emissions are:

- Released on a block-by-block basis

- Capped at 5% per year (12,500,000 INIT)

- Dynamically directed by VIP gauge votes (controlled by stakers/lockers)

How to Stake INIT

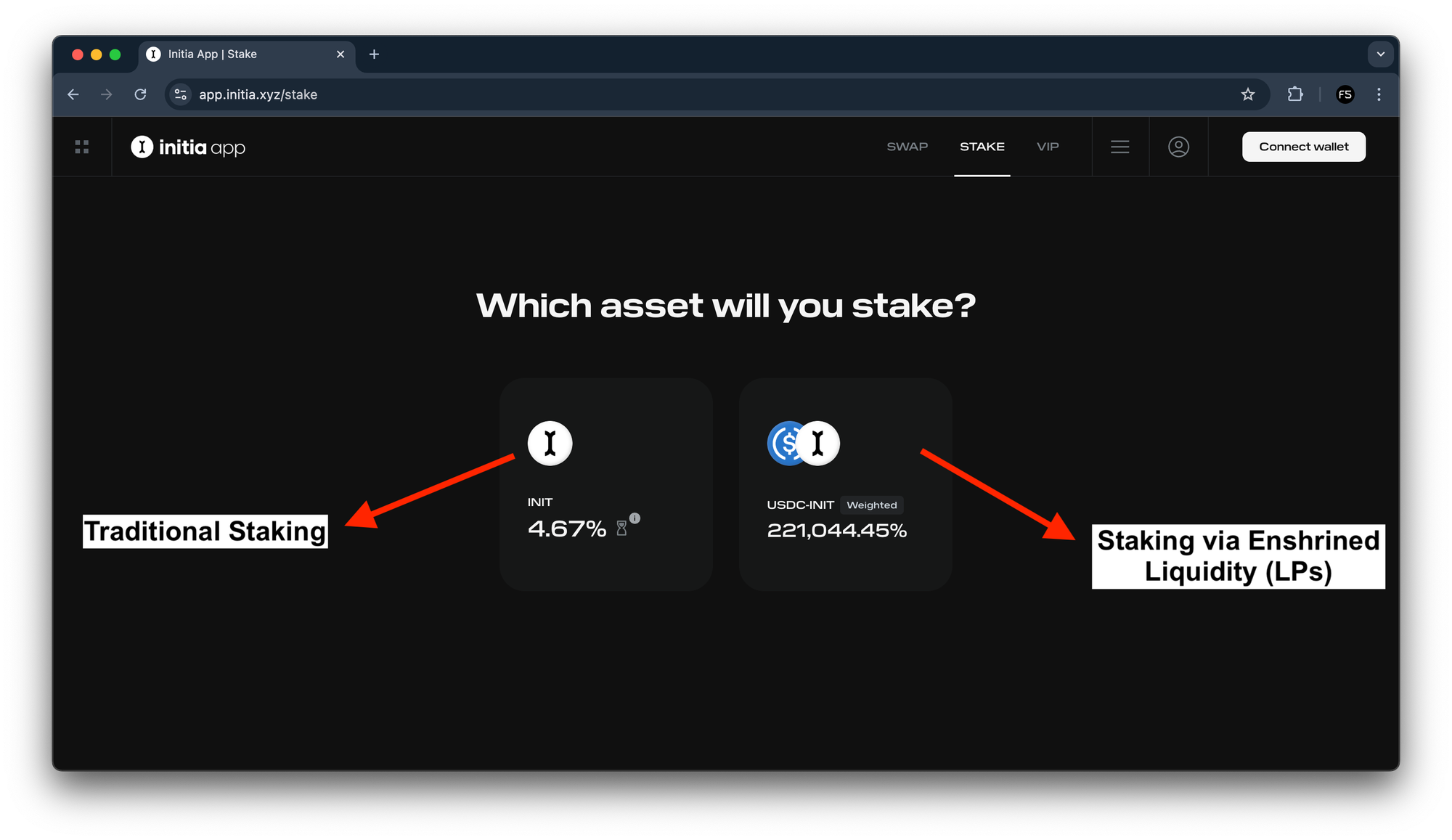

We’ll walk you through the two main ways to stake in the Initia ecosystem:

- Traditional Staking

- Using native $INIT tokens directly with validators (standard PoS staking method)

- You delegate your tokens, help secure the network, and earn INIT emissions in return. Straightforward and easy to get started with.

But like most traditional PoS systems, it comes with limitations:

- Low capital efficiency — your assets sit idle while earning rewards

- Liquidity fragmentation — staked tokens aren’t usable elsewhere in the ecosystem

- Enshrined Liquidity Staking

- Providing liquidity to specific whitelisted INIT-TOKEN pairs on InitiaDEX (e.g. USDC-INIT)

- These LP positions can be used as staking assets with validators

- Only governance-approved LP pairs qualify

- This method allows you to earn both LP fees and staking rewards

Which staking to choose

Let’s be real — classic staking is kind of the lazy option (and trust us, the Initia team doesn’t want you being lazy). Yeah, classic staking works, but the rewards are way lower compared to LP staking. If you're trying to actually make your capital work for you, Enshrined Liquidity Staking is the right move for you.

With LP staking, you’re not just earning emissions, but you’re also farming DEX fees and backing the network. All at once, it just makes way more sense.

How to Stake LP Tokens on Initia

Enshrined Liquidity, aka making your tokens hustle.

What You’ll Need

- A browser wallet, for example Keplr, Phantom, Leap Wallet, etc

- Some $INIT

- A second token to pair with INIT (like USDC, TIA, ETH, etc.)

- Access to the Initia app: app.initia.xyz

Step 1: Get Set Up for LP Staking

Before we can stake LP tokens, we need to build that LP position — and that means figuring out exactly how much INIT and the paired token (e.g. USDC) you’ll need. Let's calculate:

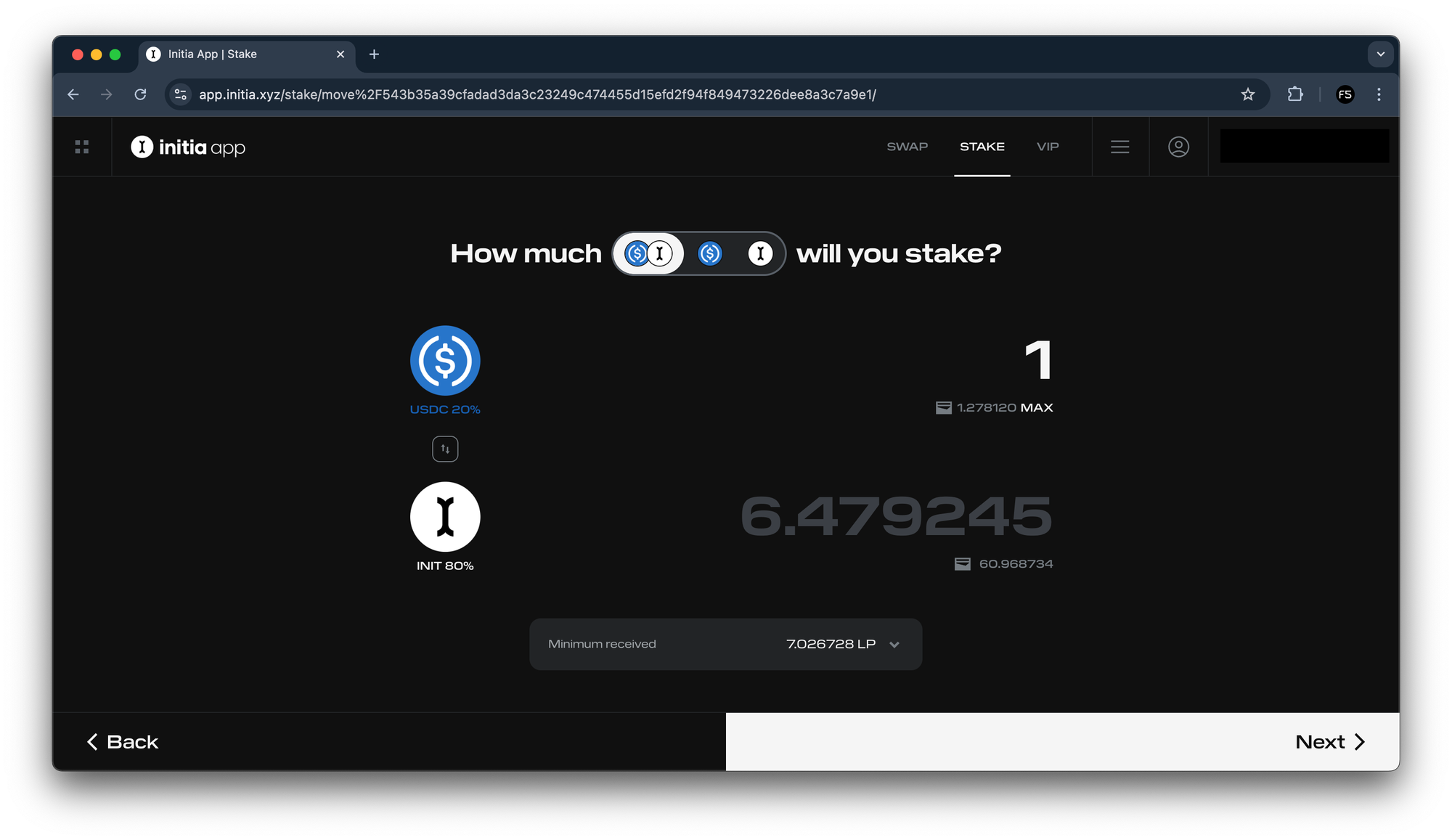

LP pools like INIT/USDC usually follow a set ratio. For this one, it's:

- 80% INIT

- 20% USDC

So if you plan to stake 500 INIT — you’ll also need around 100 USDC to match the 80/20 split. The app will calculate it automatically, but it helps to plan ahead.

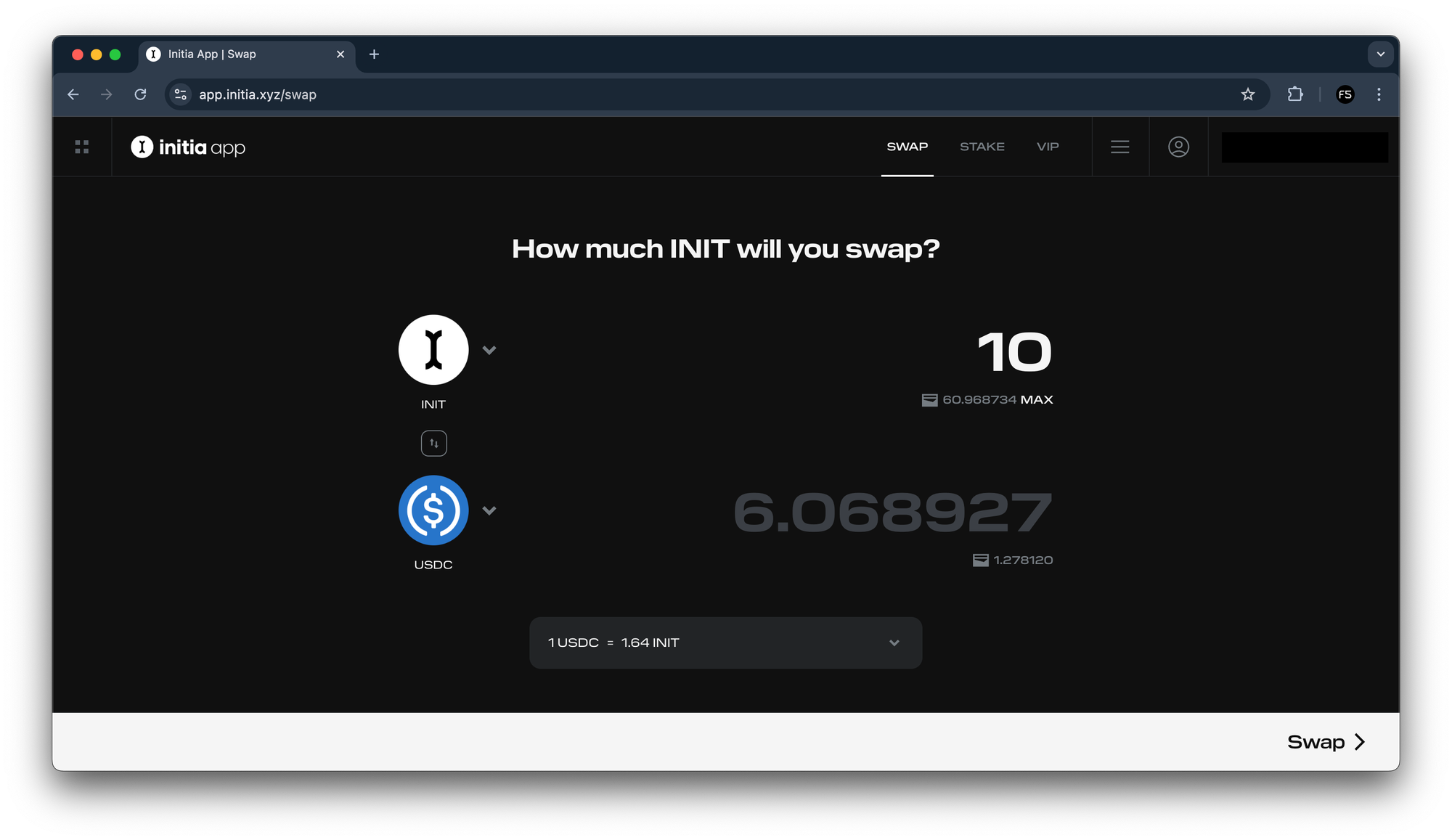

Step 2: Swap to get the paired token

If you don’t already have enough of the second token (USDC, in this case):

- Go to the Swap tab

- Choose INIT → USDC

- Swap just enough to match your intended LP size

Step 3: Go stake that LP

- Head to the Stake tab

- Choose the LP pair you want to stake (e.g. USDC-INIT)

- Enter the amount of INIT you want to use — the USDC side will auto-fill

- You’ll see how many LP tokens you’ll get in return (that’s what you’re staking)

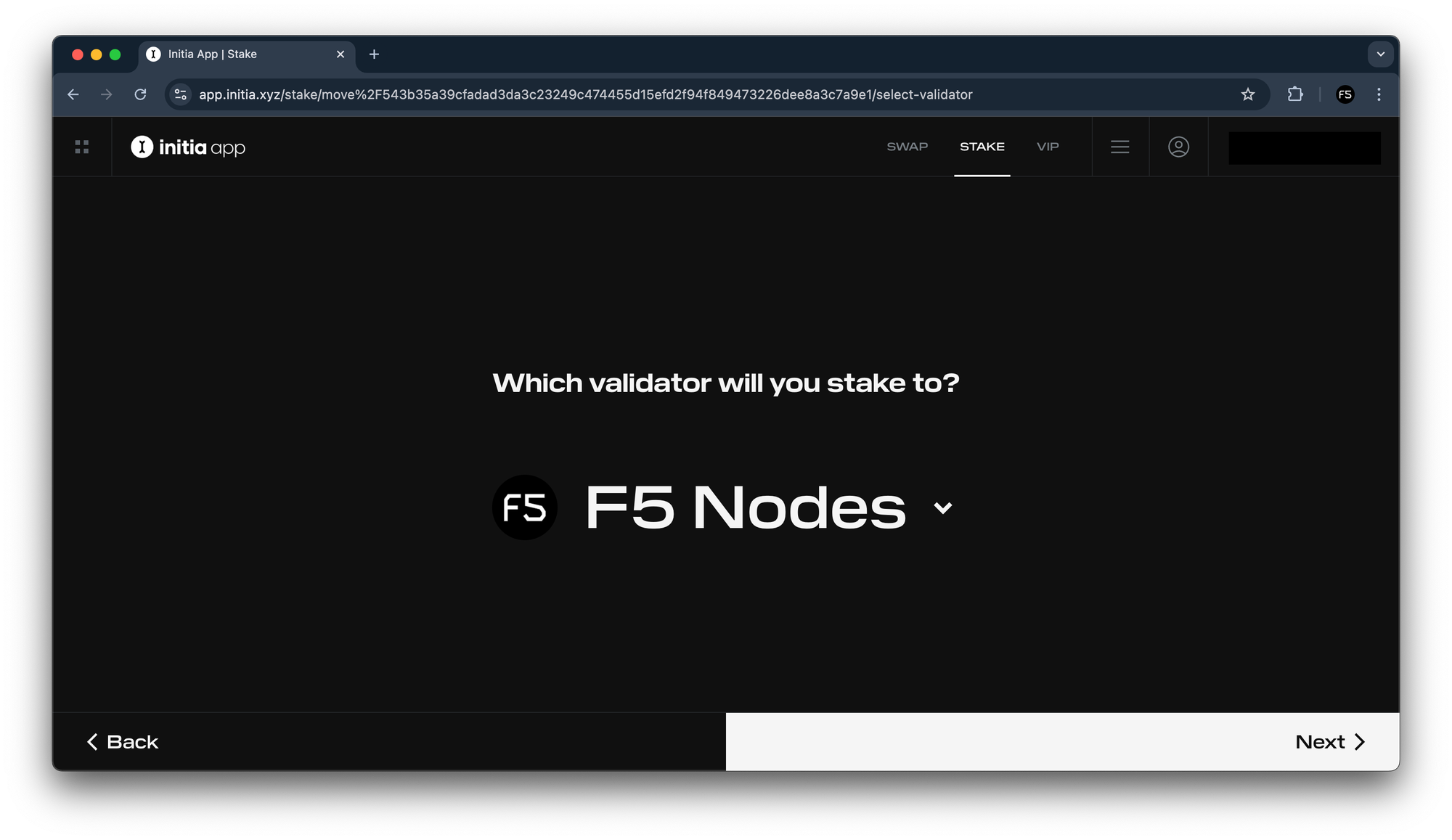

Step 4: Choose your validator

Now pick who to stake with.

Important: The validator you choose matters. A lot. If they go offline, get jailed, or charge high commission — your rewards take a hit.

We at F5 Nodes are early contributors to the Initia ecosystem. We run with 100% uptime, charge the lowest possible commission (5%), and have strong monitoring + security in place. We’re also active in the community, share educational content like this article, and always show up with support when needed.

Consider delegating to F5 Nodes and staking with a team that’s all in on Initia!

You’ll find us easily in the validator list:

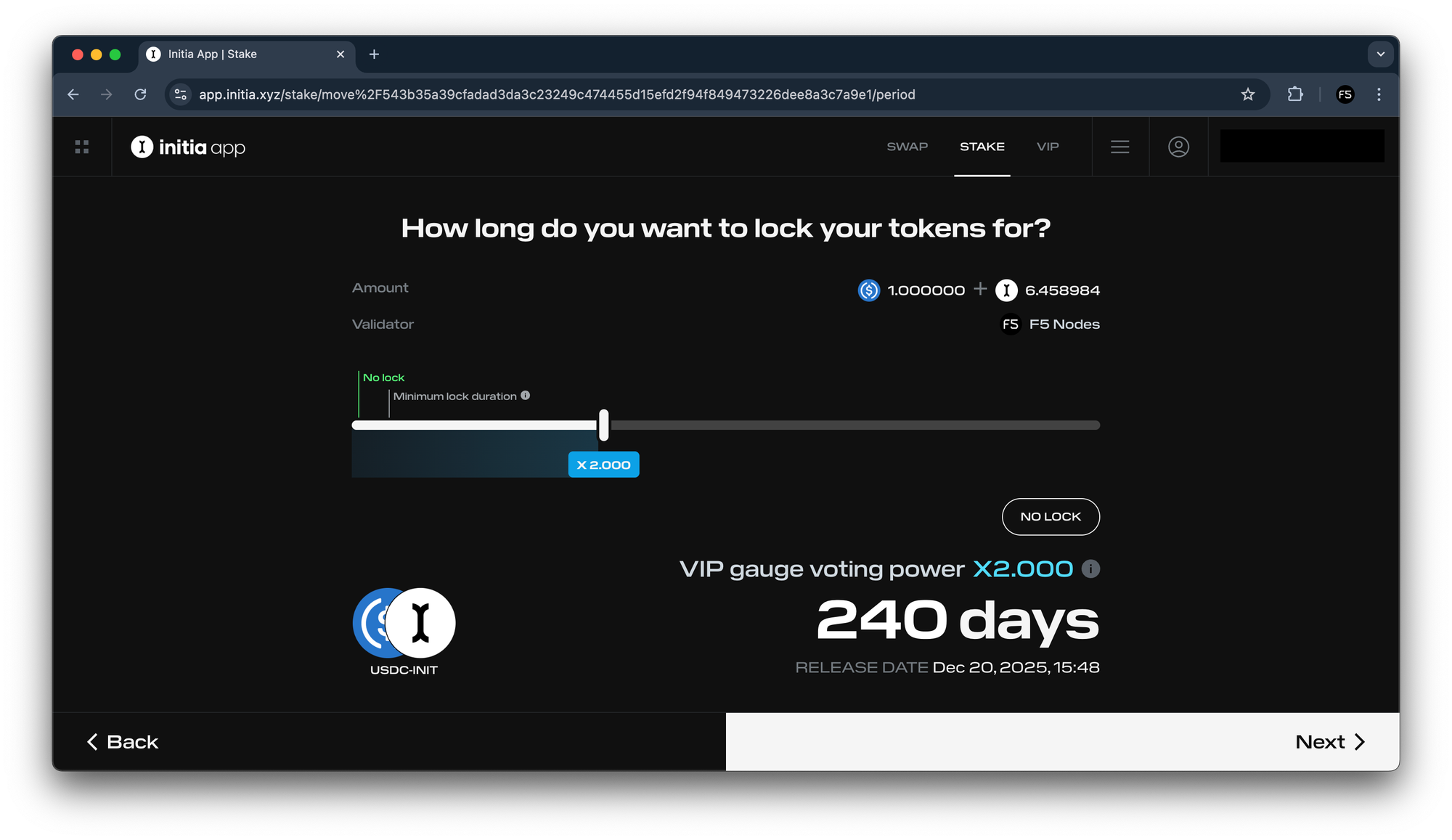

Step 5: Lock your stake (optional but smart)

You can now lock your LP position to earn more:

- Min lock: 30 days

- Max lock: 720 days

- Locking boosts:

- Your INIT reward rate

- Your voting power in VIP gauge votes

On the slider, you’ll see exactly how long you’re locking and how much boost you’re getting (e.g. 4x for 720 days). Adjust based on your strategy.

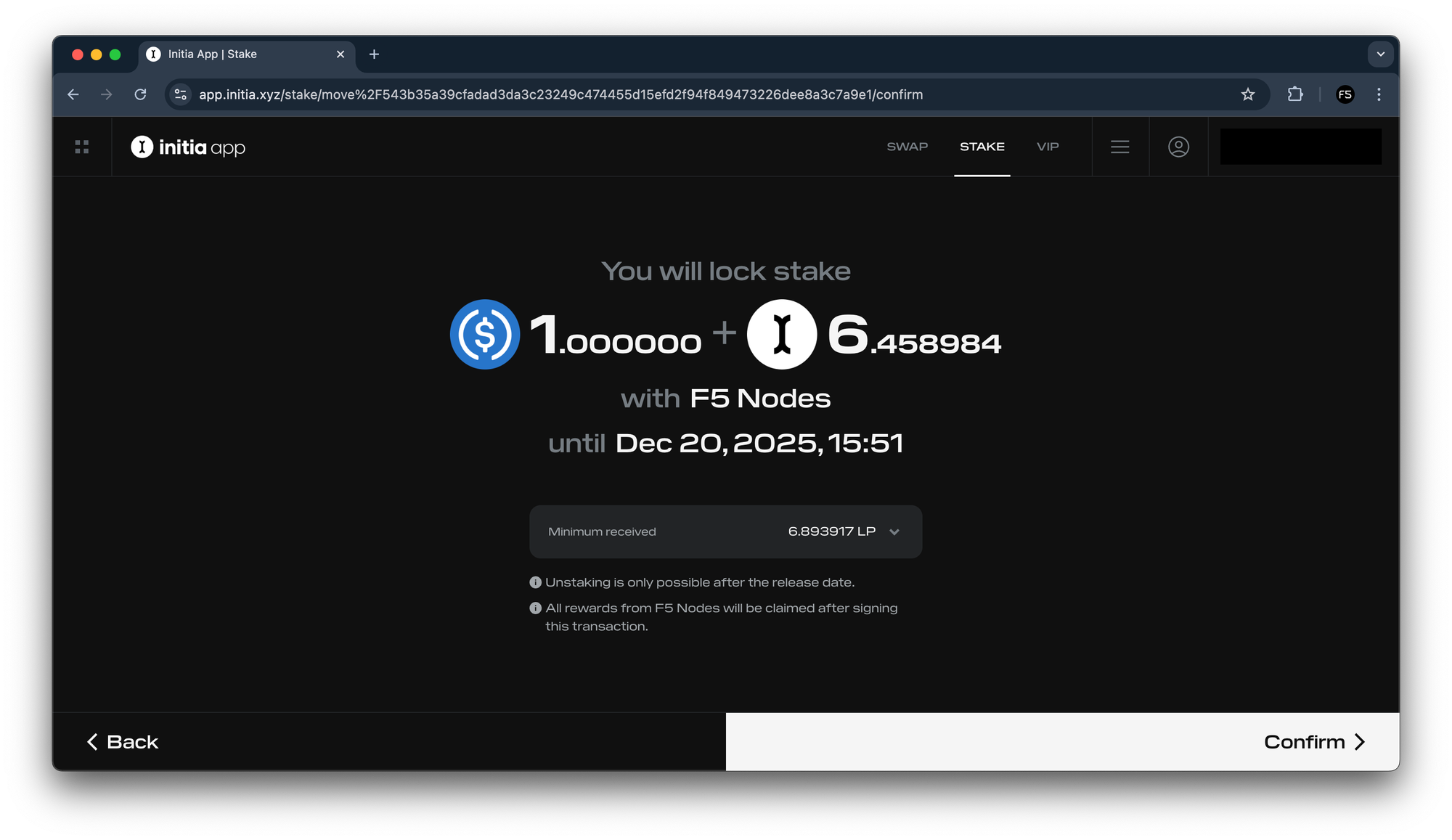

Final step: Confirm

Click Confirm, approve the transaction in your wallet, and you're done.

Your tokens are now staked, locked (if you chose), and earning on all fronts — DEX fees + INIT rewards + governance power.

If you found this guide useful, consider delegating your tokens to F5 Nodes to support what we do!

We’re all interwoven! 🪢

About F5 Nodes

F5 Nodes is a non-custodial staking provider founded in early 2021, operating across 15+ Proof-of-Stake (PoS) networks, including Celestia, Story, Initia, Dymension, Lido SDVT, Zetachain, and more. We manage ~$50 million in staked assets and are committed to providing the best possible conditions for our stakeholders. This includes an insurance fund, 24/7 customer support, and 100% slashing protection to guarantee security and reliability.

Got questions? DM us on Twitter or shoot us an email at core@f5nodes.com