A Comprehensive Guide to Staking and Securing Story L1

Discover how staking and validator selection power the security, decentralization, and future of the Story network in this insightful guide from F5 Nodes.

Introduction

If you’re part of the Story community, you’ve probably heard words like staking, validators, and network security thrown around. Maybe they sound a bit technical or you’re wondering, “Why does this even matter?”

Here’s the thing: staking is the backbone of a Proof-of-Stake (PoS) networks. It’s what keeps the network secure, decentralized, and running smoothly. And validators? They’re the key players making sure everything works as it should.

But not everyone understands how it all comes together, and that’s okay! In this guide, we’ll break everything down step by step — what staking is, why it matters, how to choose the right validator, and most importantly, how you play a critical role in securing the Story network.

Let’s get started!

How Staking Works in the Story Network

Story’s staking model is designed to be simple yet effective. Here are the key mechanics:

Validators and Delegators

Validators are network participants who run nodes to validate transactions and produce blocks. Validators are responsible for handling network upgrades, monitoring their nodes to avoid downtime, keeping their infrastructure secure and reliable, and supporting other node-related operations. Delegators are token holders who stake their tokens with validators to help secure the network.

Rewards Distribution

Validators earn rewards for their work validating transactions, producing blocks, and securing the network. These rewards are shared with their delegators after the validator deducts a commission fee, which typically ranges from 5% to 10%. The remaining rewards are distributed proportionally to the delegators based on their staked amount.

Example: Suppose a validator earns 1,000 IP tokens in rewards, and 10,000 IP tokens are staked with them. If the validator charges a 10% commission, they will keep 100 IP tokens. The remaining 900 IP tokens are shared among delegators. If you have staked 1,000 IP tokens (10% of the total stake), you would receive 90 IP tokens (10% of 900).

Slashing Penalties

Validators must act honestly and perform well; otherwise, they risk being slashed (losing a portion of the stake entrusted by their delegators). Slashing occurs in two main scenarios:

- Downtime: This happens when a validator’s node is offline and misses 95% of the past 28,800 blocks. As a result, the validator is jailed. They can unjail and return to the active set, but their delegators will irrevocably lose 0.02% of their staked amount.

- Double-signing: This occurs when a validator mishandles their key and signs one block twice. In this case, the validator is permanently jailed (tombstoned), and their delegators lose 5% of their tokens. It’s a significant and severe penalty, as the validator is removed from the network permanently.

Unstaking Period

While your tokens are staked, they cannot be transferred, traded, or used in any way — they are locked. If you decide to unstake your tokens, there is a 14-day unlock period during which your tokens are unavailable. During this unbonding period, delegators and validators do not earn block rewards, but they are still subject to slashing risks.

Why staking matters for Network security and dangers of concentrating tokens with top validators

Staking is much more than earning rewards — it’s a fundamental mechanism to ensure the security, decentralization, and reliability of the Story network.

Below, instead of dry and boring information, we’ll use simple and clear examples to explain everything in an engaging way.

Securing the Network

Imagine staking like a neighborhood watch. The more neighbors (stakers) involved, the harder it becomes for any intruder (bad actor) to break in. Validators act as the watch captains, using the resources provided by stakers to patrol the area (validate transactions and secure the network). The more tokens staked, the stronger the “security wall” becomes, making it incredibly expensive for anyone to attack the network. Without this, it would be like having an unlocked door — easy for intruders to exploit.

Important: Without sufficient staking, the network becomes vulnerable to attacks, such as 51% attacks, where a single malicious actor gains majority control of the network’s staked tokens and manipulates transactions.

Ensuring Validator Accountability

Staking doesn’t just strengthen the network; it also ensures validators stay honest. Think of it like a teacher’s classroom rules. Validators (students) have to follow the rules (stay online and validate blocks properly), or they face penalties (slashing). For example, if a validator is often absent (offline), they’ll lose points (tokens) and be benched (jailed). If they cheat (double-sign blocks), they’re expelled (permanently removed) from the class. This system ensures validators stay on their best behavior, which benefits everyone.

Supporting Decentralization and Understanding the Nakamoto Coefficient

Decentralization is at the heart of why blockchains like Story exist. It’s what makes these networks fair, secure, and resistant to individual or group control. Let’s break down what decentralization really does, and why should it matter to everyone involved in the Story network.

What is Decentralization and Why is it Important?

Decentralization means spreading power and control across many participants rather than concentrating it in just a few hands. In Story’s network, validators are responsible for making this happen — they validate transactions, produce blocks, and secure the network.

Here’s why decentralization matters:

- Stronger Security: A decentralized network is much harder to attack because control is spread out. When no single entity has too much power (amount of staked tokens with a specific validator), it’s nearly impossible for bad actors to take over.

- No Censorship: Decentralization prevents any single validator or group from blocking transactions or influencing which blocks get added to the chain.

- Keeps the Network Running: If one validator goes offline or fails, the network continues running smoothly because power is distributed among many others. To reach consensus and produce a new block, at least 66.6% of the voting power must be online.

Without decentralization, a blockchain stops being trustless and resilient. It becomes more like a traditional system where the failure of one or two key players can bring everything down.

The Nakamoto Coefficient: A Measure of Decentralization

The Nakamoto Coefficient measures how decentralized a network is by calculating the minimum number of validators that would need to collude to control the network. Simply put, the higher the Nakamoto Coefficient, the harder it is for any group to take control or disrupt the network.

Here’s how it works:

- Imagine the top 5 validators control over 50% of the total staked tokens (Voting Power). In this case, the Nakamoto Coefficient is 5, because it would only take 5 validators working together to gain control of the network.

- A higher Nakamoto Coefficient means power is spread out among more validators, making the network much healthier and harder to attack.

It’s also important to note that the number of validators doesn’t necessarily indicate how well the network is decentralized. The most important factor is how the Voting Power is distributed among these validators. For example, there could be 100 active validators, but if the top 10 control 80% or even 90% of the voting power, the network is still highly centralized. In such situations, the total number of validators becomes less relevant.

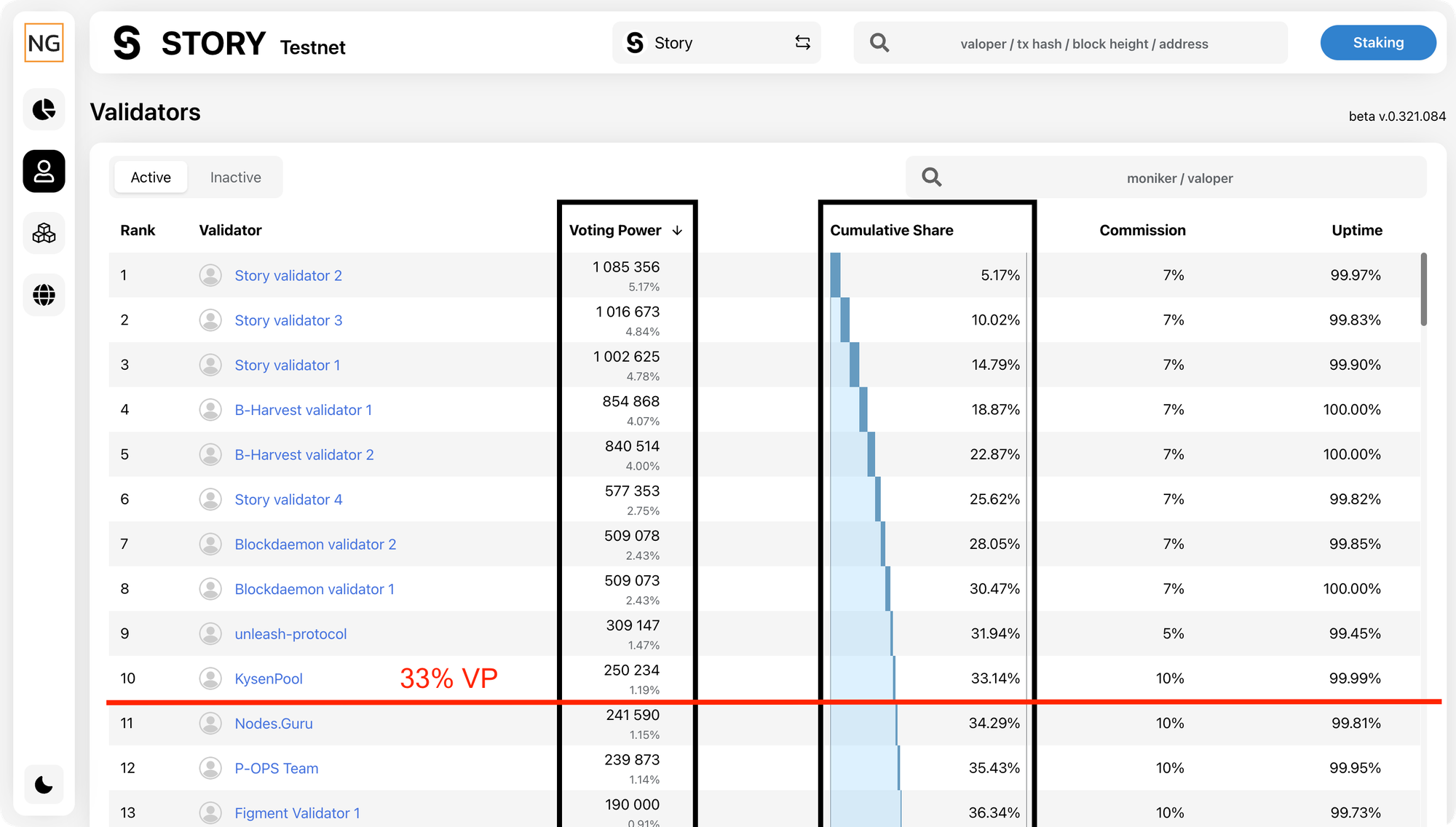

Controlling 33.33% of Voting Power (VP)

In Story’s Proof-of-Stake system, consensus requires at least 66.6% of the voting power to be online to produce new blocks. If a group of validators controls 33.33% of the total stake and decides to go offline or collude, the network cannot reach consensus. This would effectively stop the chain from producing new blocks and halt the network.

For example:

- If 10 validators together hold 33.33% of the total voting power and decide to behave maliciously or go offline, they can prevent new blocks from being created. This makes the network vulnerable if too much stake is concentrated among a small group.

In the image below, we can see the cumulative share of validators, showing that the top 10 validators currently control more than 33% of the voting power. To support decentralization and improve network security, delegating your tokens outside of these top validators is a better choice, with the greatest impact coming from delegating to validators in the lower half of the active network.

Here are the most important aspects to keep in mind:

- Avoid delegating your tokens to the top 33% voting power validators. Delegating to these validators creates a superminority, which increases the risk of network halt or censorship.

- Focus on smaller and mid-tier validators. A top-ranked validator doesn’t always indicate it’s the best choice — often, lower-ranked validators have better performance and can maximize staking rewards.

- A higher Nakamoto Coefficient reflects better stake distribution and a more robust network.

- Every token you delegate influences how power is distributed. By making informed choices, you actively contribute to building a stronger, more secure, and decentralized Story network.

How to Choose the Right Validator in Story

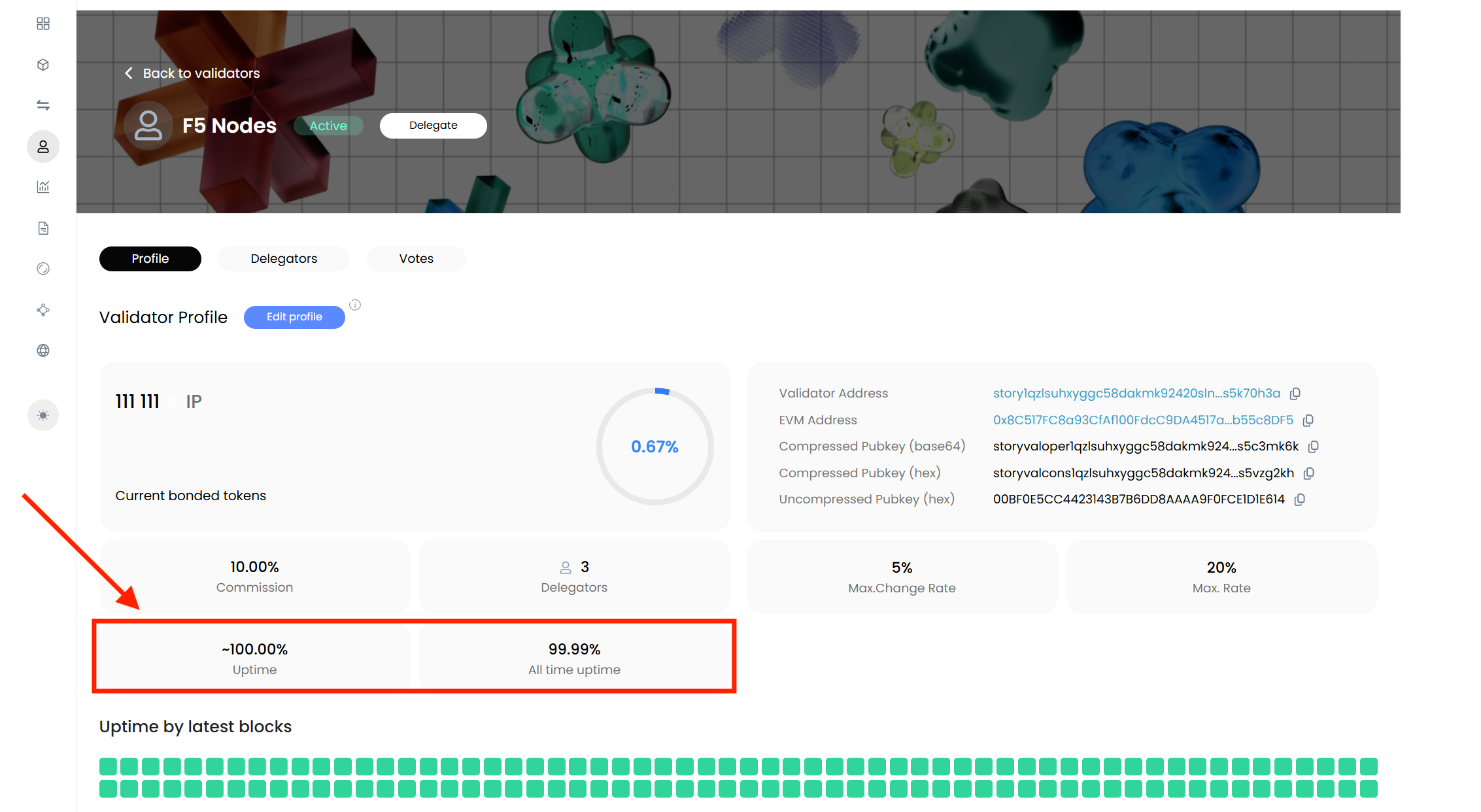

Uptime and Reliability

Uptime is one of the simplest and most important metrics to evaluate a validator’s performance. You can find this information directly in Story explorers such as Story Foundation Staking, Story Scan Validator Explorer, or Odyssey Explorer. These tools show how well a validator performs its operations and the number of blocks they’ve missed.

The closer a validator’s uptime is to 100%, the better. Anything above 99% is considered high uptime and reliable. High uptime also helps maximize your staking rewards.

- Uptime: Calculated based on the last 28,800 blocks (the current signing window), providing a snapshot of the validator’s recent performance.

- All time uptime: It represents the historical performance of a validator, reflecting their reliability over the entire period. This is definitely the most accurate metric to focus on.

Proven track record and on-chain identity

Before entrusting your tokens to any validator, it’s important to research their reputation and the networks or chains they validate (if applicable). Ensure they have a website and accessible contact information so you can reach their team with any questions or concerns. This often indicates they are reliable and responsive. Transparency is key, and it’s always recommended to support validators who actively engage with and contribute to the network they validate.

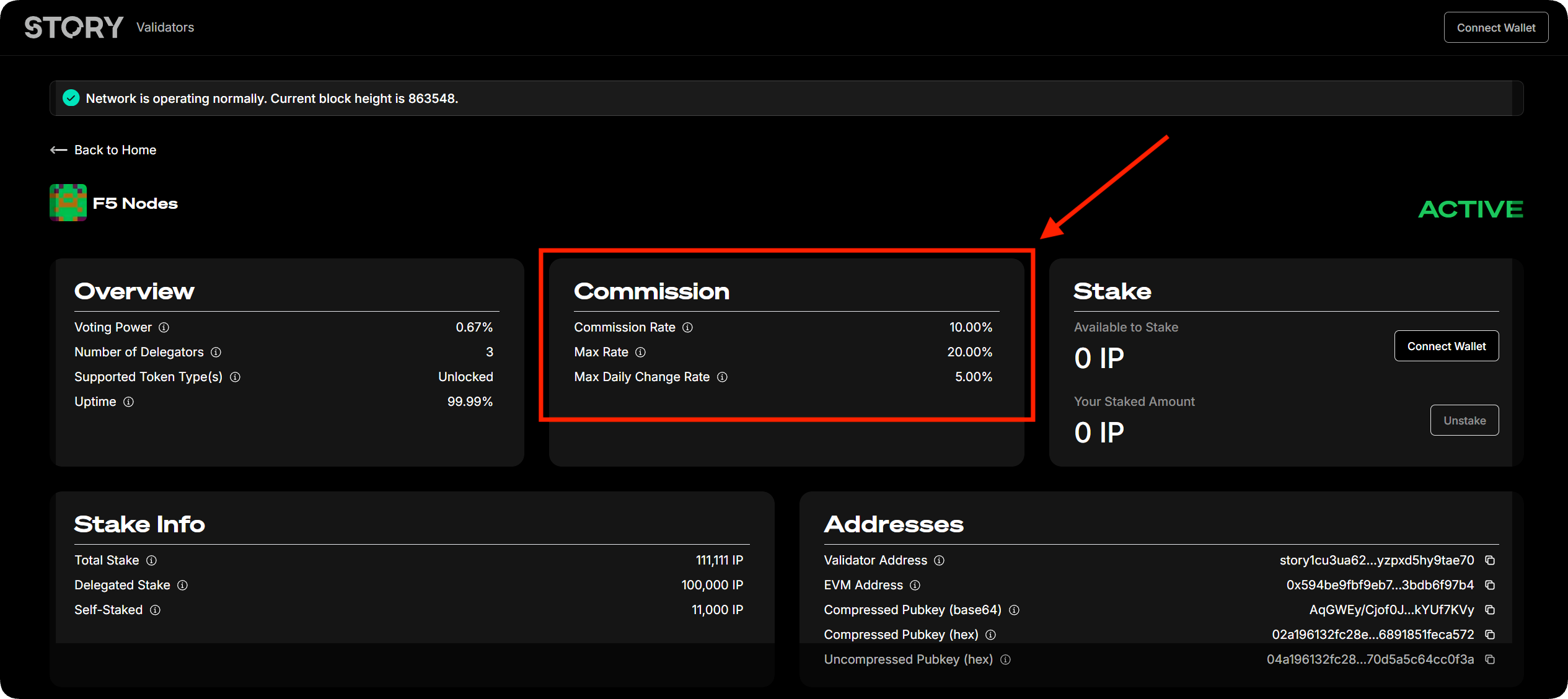

Commission Rate

To make informed decisions, it’s important to understand the three key aspects of a validator’s commission rates:

- Commission Rate: This is the current rate charged by the validator for their services. It’s the percentage of rewards that the validator retains.

- Max Commission Rate: This is the maximum rate the validator can ever set in the future. It acts as an upper limit for their commission.

- Max Daily Change Rate: This is the maximum percentage by which the validator can increase or decrease their commission rate in a single day. For example, if the max daily change rate is 5%, a validator can only increase their rate by up to 5% per day until it reaches the max commission rate.

We highly recommend choosing validators with commission rates between 5% and 10%. Validators charging 0% or close to 0% commission may seem appealing, but they often have drawbacks, such as being excluded from airdrops or lacking the necessary resources to maintain a reliable infrastructure.

Diversify your stake

Stake with 2 or 3 validators to hedge your risk of slashing. Let’s say you’re staking 10,000 IP tokens. Instead of delegating all to one validator, you could split your stake evenly across three validators (e.g., 3,333 tokens each). If one validator underperforms or gets slashed, your exposure is limited to just a third of your total stake.

Avoid Red Flags

When picking a validator, there are some clear signs you should steer clear of:

- Frequent downtime or missed blocks: If a validator can’t stay online consistently, it’s a bad sign for reliability and could lead to slashing or lower rewards.

- Extremely low commission fees: Validators charging 0% or close to it might not have the resources to keep their operations sustainable in the long run.

- Lack of transparency or communication: If a validator doesn’t provide updates, share contact info, or engage with the community, it’s hard to trust them to do their job properly.

Tip: Don’t be tempted by a validator offering 0% commission but failing in other areas like performance or communication. It’s just not worth the risk. Go with someone you can trust to keep the network secure and running smoothly.

About F5 Nodes

F5 Nodes is a non-custodial staking provider founded in early 2021, operating across 15+ Proof-of-Stake (PoS) networks, including Celestia, Dymension, Lido SDVT, Zetachain, and more. We manage ~$50 million in staked assets and are committed to providing the best possible conditions for our stakeholders. This includes an insurance fund, 24/7 customer support, and 100% slashing protection to guarantee security and reliability.